Home of Blogs Updates

Search

Have an existing account?

Sign In

© Foxiz News Network. Ruby Design Company. All Rights Reserved.

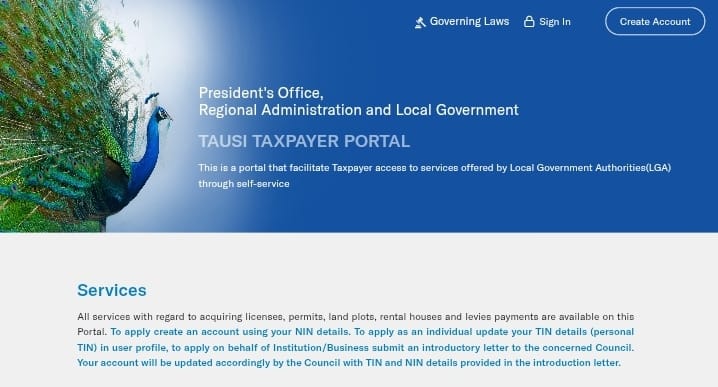

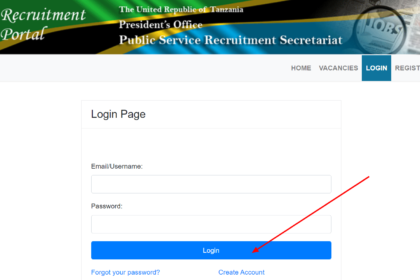

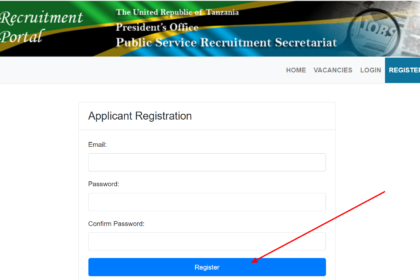

TAUSI Portal Login And Register (https://tausi.tamisemi.go.tz/)

By

Uniforumtz

TAUSI Portal Login And Register (https://tausi.tamisemi.go.tz/): Revolutionizing Access to Local Government Services in Tanzania The President’s Office, Regional Administration, and…

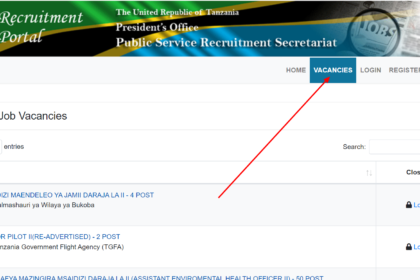

Fire and Rescue Force Recruitment Portal (ajira.zimamoto.go.tz)

By

Uniforumtz

The Fire and Rescue Force Recruitment Portal (ajira.zimamoto.go.tz) is an online platform designed to facilitate the recruitment process for individuals…

NBC Premier League Table 2024-2025

By

Uniforumtz

NBC Premier League Table 2024/2025: Latest Standings (Msimamo Wa Ligi kuu NBC) The NBC Premier League is back in action,…

Matokeo Ya Yanga Vs TP Mazembe Today

Matokeo Ya Yanga Vs TP Mazembe Today, Today, football fans across Tanzania and beyond eagerly…

Top Assists NBC Premier League 2024-2025

Top Assists NBC Premier League 2024-2025. The NBC Premier League 2024-2025 season has been an exciting…