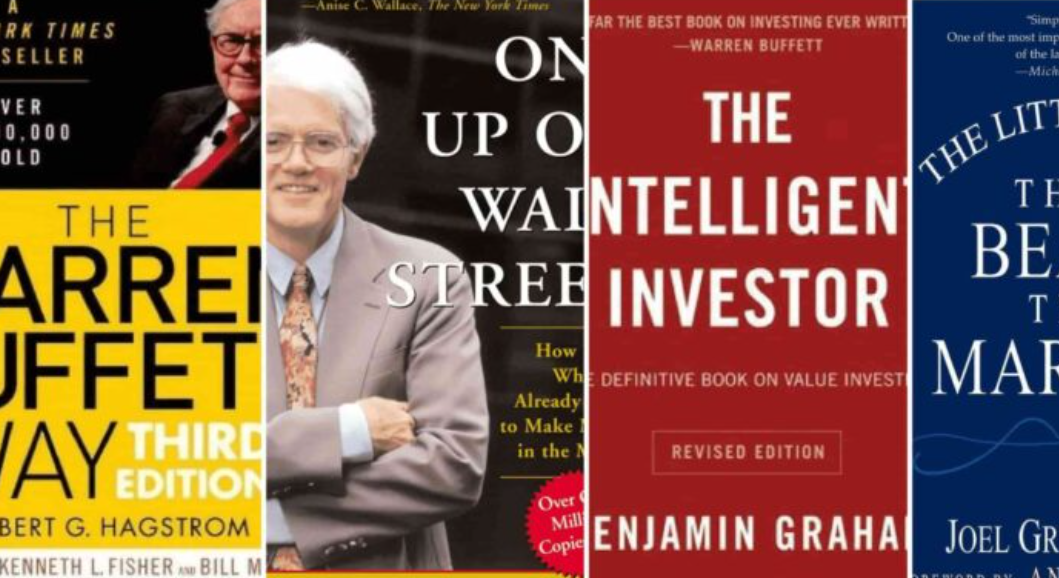

The Best Investing Books Of All Time. The stock market is one of the most exciting places to invest. It gives you the opportunity to build wealth over time. But it can also be intimidating. How do you make sense of all the data, information and news? Where do you start? When should you buy or sell? While there are many investing books out there (and even more on our list), these are some of the best investing books for beginners and intermediate investors alike.

The Best Investing Books Of All Time

Ben Graham, ‘The Intelligent Investor’

Ben Graham was a professor of economics at Columbia University and is considered the father of value investing. The Intelligent Investor, originally published in 1949 and revised by Graham’s student Jason Zweig in 2003, is the definitive guide to investing for those who want to learn more. It’s one of few investing books that has stood the test of time and because it focuses on identifying undervalued stocks and companies, its principles still apply today.”The fact that these lessons have been around since 1949 doesn’t make them any less relevant,” says Patrick O’Shaughnessy, co-founder of venture capital firm O’Shaughnessy Asset Management. “Too often we get caught up with new buzzwords or fads.”

Zweig also notes that this book can be read as an introduction to Benjamin Graham’s Security Analysis (1934), which he considers “one of the best books ever written about fundamental equity analysis.”

Michael Mauboussin, ‘More Than You Know’

This book is about the importance of understanding the difference between skill and luck. In it, Mauboussin draws from his work with many of the best investors in history to show how they separate themselves from others by making more accurate predictions. He also provides readers with tools they can use to make their own predictions more closely resemble those of experts. You can find this book on Amazon or at all good bookstores.

Howard Marks, ‘The Most Important Thing’

If you’re looking for a book that will help you become a better investor, then this is it. The author is one of the most successful hedge fund managers in history and he gives plenty of advice on how to think about investing and life.

This book is about being a lifelong learner, so if you don’t have time to read an entire book on investing, at least read these two paragraphs from chapter four: “Don’t trust anyone who says they know everything (or anything). And don’t trust yourself when your emotions tell you something can’t happen or won’t happen because of X reason. If anyone tells you that they know what will happen tomorrow whether it’s tomorrow morning or next year they’re lying to themselves as much as they’re lying to you.”

Philip Fisher, ‘Common Stocks and Uncommon Profits’

In his book, Fisher outlines a general approach to investing in common stocks. He advocates an investment style that emphasizes quality at a reasonable price. This is the basis of what is now known as the “Growth at a Reasonable Price” (GARP) investing strategy. Greenblatt created his own version of this approach, called “MAGIC,” which stands for:

M for Market Capitalization (Market cap), A for Absolute Bargain Price (Absolute BV), G for Growth Rate Potential and I for Intrinsic Value (BV/EBITDA).

Joel Greenblatt, ‘You Can Be a Stock Market Genius’

Joel Greenblatt is a hedge fund manager, author, and professor. He’s written several books, but the one I’ll be focusing on today is You Can Be a Stock Market Genius: Uncover the Secret Hiding Places of Stock Market Profits.

The book was first published in 2007; it seeks to help readers understand what makes stocks rise or fall and how to invest wisely. Its most important points include a framework for calculating how much money you can expect from your investments (the Magic Formula) and why many investors fail at picking stocks (the Peter Principle).

Jason Zweig, ‘The Intelligent Investor’

Why it’s important:

This book is considered to be one of the best investments books of all time. The author, Jason Zweig, is a well-known financial journalist who has been writing about investing for over 30 years. He reviews and analyzes several classic texts on value investing and explains why they’re so important in today’s volatile market climate.

Whether it’s right for beginners:

The chapters are short and easy to read, which makes this book quite accessible even if you’re not an experienced investor but if you want more depth or background information on any specific topic (like how the stock market works), there are other sources out there that provide more detail on those topics so you can do your own research instead of relying solely on what Zweig says in his book.

How it’s structured:

There are 14 chapters that cover everything from learning how markets work (which is crucial) up until advanced strategies like options trading and hedging against currency fluctuations with futures contracts. Each chapter covers one topic at length before moving onto another area of investment strategy; each section ends with questions for reflection followed by suggested reading materials about related concepts covered earlier in the chapter itself. Overall this format makes learning new material easier because readers aren’t overwhelmed with too much data at once but rather get a chance to contemplate their own thoughts as well as ideas shared by other authors/speakers throughout history who have written similar pieces before them.”

Phil Town, ‘Rule #1’

Phil Town is a successful investment author and the founder of Town Capital Management. He’s also the founder of the Rule #1 Investor Conference, an annual conference that brings together some of the world’s top investors to teach others how they make their money.

In his book “Rule #1,” Phil shares his rules for investing in stocks. The main rule is simply: buy good companies at bargain prices, meaning you have to pay less than what it’s worth to own all its future cash flows. Phil believes that anyone can do this if they follow his simple rules and he shows readers how to do so by sharing stories from his own career as an investor along with lessons learned from some great investors like Warren Buffett and Peter Lynch (founder of Fidelity Investments).

Seth Klarman, ‘Margin of Safety’

The margin of safety is a concept that’s used in both investing and insurance. It refers to the difference between the current price of a stock and its intrinsic value. The idea behind it is that when you’re buying something, whether it be an investment or an insurance policy, it’s always better to pay less than what something is worth.

If you don’t have enough money to buy a stock at its intrinsic value (the true value), then it can still be a good purchase if your price is near the actual value (the margin). If you do have enough capital for this, however, then you should always aim for purchasing at this “sweet spot.” There are many different metrics used for determining what constitutes being within the margin of safety range; some will set rules based on percentiles or other figures from historical data while others rely on their own judgment calls based on experience.

Irving Kahn, ‘The Economics of Success and Failure in the Modern Corporation’

The Economics of Success and Failure in the Modern Corporation by Irving Kahn is about how companies can produce value for their shareholders. It was first published in 1958 and it has been updated several times since then.

It’s a book that I’ve read many times over the years, but my favorite part is when he talks about how to evaluate businesses: “The criterion for judging an investment project… should be based on its ability to survive competition from within and without.” He had some great insights into how success or failure happens at corporate level – it’s not just about product quality or management skills; sometimes it’s also about luck!

William O\’Neil, ‘How to Make Money in Stocks’

William O’Neil is a Wall Street legend. He’s the founder of Investor’s Business Daily, which has been around since 1923 and is still a relevant resource for investors today. His best-selling book How to Make Money in Stocks was originally published in 1962, but it remains one of the most important investing books ever written. In fact, if you’re looking for something to teach yourself about investing from scratch, this might be one of your best options (besides our own guide).

O’Neil says that there are four basic principles that people should adhere to when trying to make money with stocks:

- Buy low and sell high

- Don’t try to time the market; instead buy stocks over time so that you can average out any ups and downs along the way

- Don’t buy individual companies buy sectors or indexes instead because they’re more likely to outperform individual companies over time due to diversification benefits

Conclusion

So, there you have it. If you’re looking for a few good books on stock investing, these are some of the best ones on the market right now. With so many different choices available, it can be hard to know where to start. But if I were in your shoes, I would start by reading “The Most Important Thing: Uncommon Sense for the Thoughtful Investor,” by Howard Marks.

This book covers everything from how to think about valuations to understanding how much risk is appropriate for your portfolio. After that one has been digested thoroughly and hopefully put into practice you might want to try something more specific like “How to Make Money in Stocks: A Winning System in Good Times and Bad (New York Times bestselling edition),” by William O’Neil.”