Get all information about Bima Verification Online (Angalia Bima Ya Gari) TIRAMIS, Tanzania Motor Vehicle Insurance Cover Validation, TIRA MIS & Bima Verification, TIRA Motor Vehicle Insurance Cover Validation. The Tanzania Insurance Regulatory Authority (TIRA) is the regulatory body responsible for overseeing the insurance industry in Tanzania. TIRA’s full name is actually TIRA-MIS, which stands for TIRA Management Information System. It is an online platform developed by TIRA to facilitate the registration, licensing, and monitoring of insurance companies, brokers, agents, and other insurance intermediaries operating in Tanzania.

TIRA-MIS serves as a central repository for insurance-related data, enabling TIRA to effectively regulate and supervise the insurance sector. The system provides a range of services, including online registration, license renewal, and reporting mechanisms for insurance companies. It also offers tools for monitoring compliance, conducting inspections, and enforcing regulatory requirements.

What are the requirements for TIRA?

The requirements for TIRA, the Tanzania Insurance Regulatory Authority, can vary depending on the specific purpose or interaction with the authority. However, here are some general requirements that may be applicable:

- Registration: Insurance companies, brokers, agents, and other intermediaries need to meet certain criteria and submit the required documents to be registered with TIRA. These requirements typically include proof of financial stability, compliance with licensing regulations, and submission of relevant application forms.

- Licensing: To obtain a license to operate as an insurance company, broker, or agent in Tanzania, applicants must fulfill specific requirements outlined by TIRA. These requirements often involve demonstrating technical competence, financial capability, and compliance with regulatory guidelines.

- Compliance: Insurance companies and intermediaries are required to comply with TIRA’s regulations and guidelines, which encompass various aspects of their operations, including financial reporting, solvency requirements, consumer protection, and claims handling procedures.

How to check insurance status of car Tanzania (Bima Verification Online)?

To check the insurance status of a car in Tanzania, you can follow these steps:

Contact the insurance company

Reach out to the insurance company through their customer service channels, either by phone or email. Provide them with the necessary details, such as the car’s registration number, policy number (if available), and any other relevant information they may require.

Bima Verification Online (Angalia Bima Ya Gari) TIRAMIS

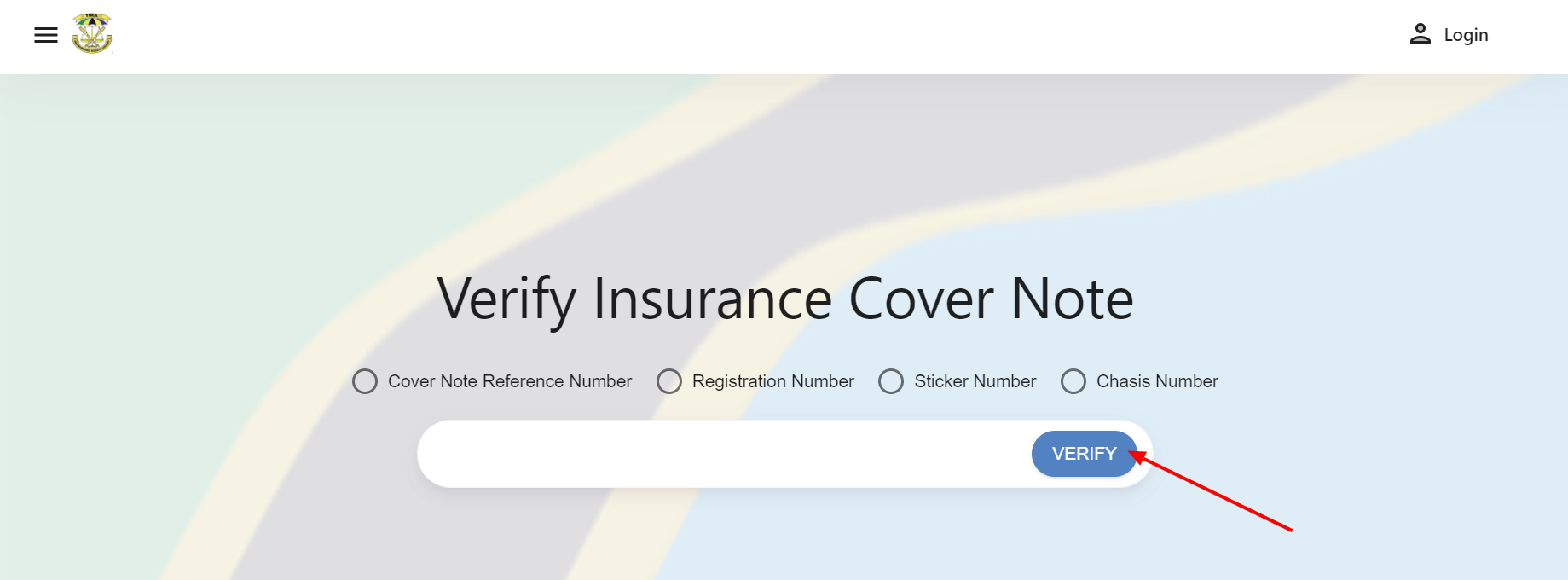

To checkfor Tanzania Motor Vehicle Insurance Cover Validation, TIRA MIS & Bima Verification, TIRA Motor Vehicle Insurance Cover Validation for Verify Insurance Cover Note;

- Visit TIRAMIS official website link https://tiramis.tira.go.tz/#/

- After page open enter one of the following below;

- Cover Note Reference Number

- Registration Number

- Sticker Number

- Chasis Number

- The click verify button amd wait for results

What are the functions of Tira?

The functions of TIRA include:

- Regulation and supervision: TIRA is responsible for regulating and supervising the insurance industry in Tanzania. It sets and enforces rules and guidelines to ensure fair practices, consumer protection, and stability within the sector.

- Licensing and registration: TIRA manages the licensing and registration process for insurance companies, brokers, agents, and other intermediaries. It assesses their eligibility and grants them permission to operate in accordance with the relevant regulations.

- Policy development: TIRA participates in the development and formulation of insurance-related policies and regulations to promote the growth and stability of the industry. It collaborates with stakeholders to establish frameworks that support the overall development of the insurance sector.

- Consumer protection: TIRA plays a crucial role in safeguarding the interests of insurance policyholders and the public. It monitors the conduct of insurance companies and intermediaries to ensure fair treatment of consumers and adherence to ethical practices.

- Financial supervision: TIRA oversees the financial aspects of insurance companies, including monitoring their solvency, financial reporting, and compliance with capital adequacy requirements. This helps maintain stability and ensures that policyholders’ claims can be met.

- Market conduct oversight: TIRA monitors the market conduct of insurance companies, brokers, and agents to ensure compliance with regulations. It investigates complaints and takes appropriate action against entities found to be engaging in unfair practices or misconduct.